Samsung And Apple Retain First And Second Ranking In Worldwide Smartphone Shipments

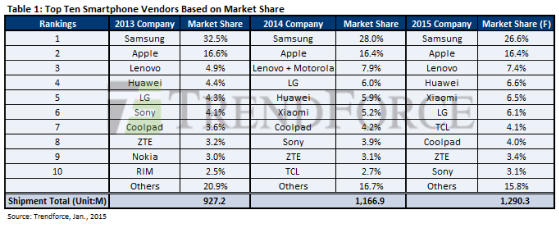

Market research firm Trendforce observes that 2014 was a difficult year for Samsung, as its market share dropped to 28% compared with 32.5% of the previous year. Nonetheless, Samsung retained its number one position. According to Wu, Samsung’s large-size, high-end Galaxy Note series faced stiff challenges from iPhone 6 Plus, while its midlevel and low-end smartphone shipments were undercut by inexpensive Chinese brands. As a result, Samsung’s overall shipment target had undergone downward revisions since the beginning of 2014, with annual growth in shipments only at 8.4% (around 326.4 million units).

In 2014, Apple maintained its high annual growth rate of 24.5%, which translates to 191.3 million units shipped worldwide for the entire year. With 16.4% market share, Apple was a solid number two in the worldwide smartphone rankings, and its position was attributed to the success of its first large-size smartphone model, the iPhone 6 Plus. This new category addressed Apple’s lack of smartphones with above 5″ screens and thus significantly raised the fourth quarter shipping ratio.

As for LG, its strategy of “promoting high quality products at low prices” paid off with strong market reception to its flagship smartphone models, ranging from G2/G2 Pro to the newest G3. “Right now G3 is the first smartphone outfitted with a 2K screen that gives users better viewing experience,” said Wu, “and this showed LG’s advantage of having a display panel manufacturer as under its wings.” For that reason, LG was the dark horse of 2014 with its ranking jumped up to number four and annual shipment growth at 75.4% (70 million units shipped).

Chinese brands represent six of the global top ten due to their high C/P products and rising domestic demands in China

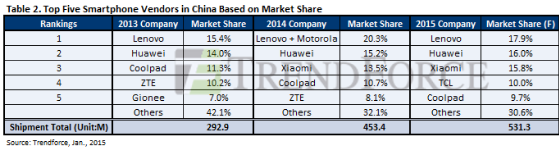

Lenovo officially completed its acquisition of Motorola from Google in the fourth quarter of 2014. The acquisition and reorganization process took almost a year since Lenovo’s announcement. With the merger finalized, Lenovo’s total shipments in 2014 exceeded 90 million units and its annual growth surpassed 100%. It ranked first place among Chinese smartphone vendors and third worldwide with its 7.9% global market share.

With the introduction of the Honor 6 model in 2014, Huawei wholly changed its strategy of using smartphone chips from Qualcomm and MediaTek for its high-end products. Honor 6 is packed with Kirin 920, a 4G chipset developed by Huawei’s subsidiary HiSilicon. “HiSilicon’s product roadmap shows that in the future it will pursue R&D in midlevel and lower-end products,” says Alan Chen, Chinese smartphone analyst of TrendForce, “and Huawei also determines to eventually become self-reliant in chipset supply.” With approximately 70 million units shipped and an annual growth around 70%, Huawei was ranked number five in the 2014 worldwide smartphone shipments. The company benefitted from its unproblematic overseas expansion, its rapid growth within China, and its good working relations with telecom operators.

As for the smartphone makers with the best cost-performance products, the title goes to Xiaomi. Its flagship models cost around US$300 to US$350, but they match their high-end counterparts from international vendors in hardware specs. Since its rise in China during the latter half of 2011, Xiaomi has been able to more than double its growth each year. Its 2014 annual shipment growth exceeded 200% with 60 million units shipped, and at one point managed to edge out the leading vendors in China such as Samsung, Huawei, and Lenovo. Xiaomi ranked six worldwide in 2014.

Chen further observes that MediaTek’s success with complete reference design for 3G chips allowed the company to take over China’s smartphone market in the last few years, creating difficulties for the top manufacturer Qualcomm. With Chinese telecom operators actively promoting 4G smartphones in 2014, however, Qualcomm came back strongly based on its adoption and enhancement of MediaTek’s model. Qualcomm’s 4G solution for smartphone OEMs, which is better priced and more in tune with Chinese clients, threatened MediaTek’s standing in China. According to TrendForce, 4G smartphone’s penetration rate in China was around 20% in 2014 and estimated to exceed 40% in 2015.

TrendForce is a global provider of the latest development, insight, and analysis of the technology industry. Having served businesses for over a decade, the company has built up a base membership base of 175,000 subscribers.

For more information, visit:

http://press.trendforce.com/