Global PC Shipments Fall 7% In Q1/15 As PC Growth Engines Grind To A Halt

The global PC market, including tablets, experienced a year-over-year sales decline of 7% in Q1 2015, reaching 115.7 million units worldwide, says market analysis firm Canalys, which differing from most other market researchers includes tablet computer sales under the “PC” categorization umbrella.

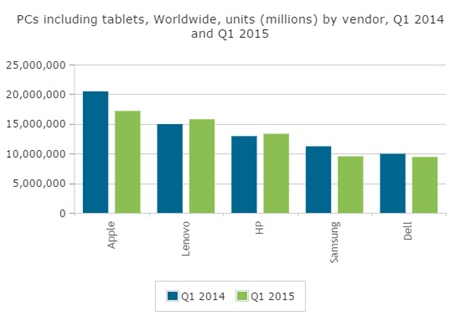

With iPad sales factored in, Apple held on to first place despite a 16% decline in its total PC shipments. Apple shipped 17.2 million units, in the quarter taking a 15% share of the market. Lenovo and HP, in second and third place respectively, both saw single-digit shipment growth in Q1 2015 and increases in market share. Samsung narrowly held on to fourth spot as its declining tablet sales led to Dell closing the gap in fifth place. Samsung and Dell took 8.2% shipment market share with 9.5 and 9.4 million units respectively.

“The growth drivers that previously helped the market through 2014 will have little effect this year. Vendors are struggling with exchange rate fluctuations which is making financial planning more difficult and forcing price increases,” comments Tim Coulling, Canalys Senior Analyst. “These challenges, combined with a softening of demand as Windows 10 draws nearer along with Microsoft’s free upgrade plans, means PC market declines will be greater in the second quarter than they were in the first.”

Desktop shipments were hardest hit, falling 13%, with declines affecting all global regions. “The desktop category no longer benefits from shipments driven by XP migration,” notes Rushabh Doshi, Canalys Analyst. “As a result, we expect to see significant shipment declines in 2015 when compared to 2014.”

The notebook market fared somewhat better, but after twoacing quarters of falling less than 1%, Canalys reports that declines have now increased to 4%, predicting that he notebook category will be f significant challenges for the rest of the year as Microsoft has restricted its Windows with Bing program to notebooks with sub 14-inch screen sizes. “Channel inventory has been building since Microsoft announced the change and this will need to adjust before significant orders return,” says Doshi. “Any price rises for Windows notebooks will play into the hands of Google who is making strides in improving Chrome OS for both consumers and businesses.”

The tablet market declined around 9% year-over-year to 45.6 million units, with market leaders Samsung and Apple experiencing double-digit shipment declines as demand for the category has cooled. “Rapid growth in the tablet market over the previous four years resulted has caused markets in Western Europe and North America to become highly penetrated and shipment volumes have started to decline. Growth in these markets now relies on consumer replacements or increasing business purchases, neither of which looks likely to pick up significantly in the coming quarters,” says Coulling. “We are continuing to see the tablet market slowing down in less penetrated markets, where large smartphones are now replacing tablets and other devices for accessing the Internet.” Smartphones with screen sizes larger than 5.5-inches made up 31% of shipments in China in the quarter. As this segment grows, tablets under 8-inches like the iPad mini are declining, and now comprise up just 41% of the Chinese tablet market this quarter compared to 66% a year ago.

Hybrid and convertible shipments doubled year-over-year in Q1 2015, reaching 3.0 million units. Asus headed that market with 28% market share, followed by Lenovo and Acer with 19%. The market for two-in-one devices is expected to continue to grow during 2015 as consumers become more accustomed to new form factors. In addition, Windows 10 will provide a better user experience when switching between tablet and notebook modes on these devices.

An Insight @Canalys app available for free on the Apple App Store provides access to a growing library of market-leading research and intelligence, free of charge, presented in clear and accessible graphs, charts and tables that can be easily saved and shared. Users can also search for information on a particular industry sector to get right to the data the searcher is interested in. These technology sectors include: smart phones and mobile phones, tablets and PCs, apps and app stores, wearables and appcessories, unified communications, enterprise IT networking and security, data centers, and IT channels.

You can also view vendor and operating system market shares, country splits, market sizing and forecasts, and so forth, with regularly refreshed content giving you the latest insight.

The Insight @Canalys app requires iOS 6.0 or later, and is compatible with iPhone, iPad, and iPod touch.

For more information, visit:

https://itunes.apple.com/us/app/insight-canalys/id735929681?mt=8

Canalys Website:

http://www.canalys.com/