Apple Mac Current And Future Sales Trends Dissected

Seeking Alpha’s J.M. Manness has posted a thoroughgoing analysis of historic, recent, and projected sales of Apple device hardware, with particular reference to somewhat contradictory Mac sales reports from market analytics firms IDC and Gartner earlier this month.

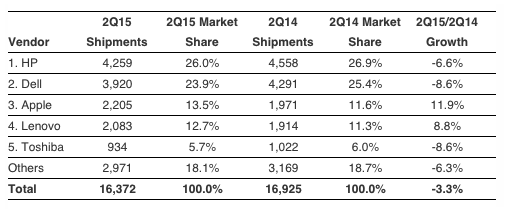

IDC’s metrics showed PC shipments totalling nearly 16.4 million units in 2Q15, during which U.S. personal computer market shrank 3.3 percent from its performance in the same quarter a year previous. However, while most vendors suffered volume decline, IDC reported that Apple continued to outperform other vendors, with growth of 16.1 percent globally, thanks largely to refreshed products like the 12-inch MacBook, and a relative concentration of shipments in the U.S. with its improving economic environment.

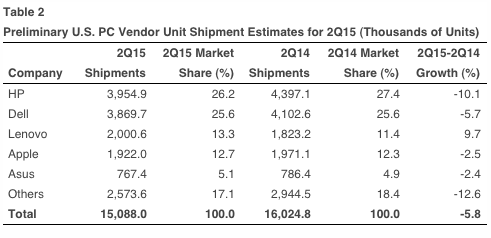

IDC says Apple is now a solid number 3 in domestIc sales, behind only HP and Dell, with 13.5 percent of the U.S. PC market. Gartner, on the other hand has Apple in fourth place in its home market with a 12.7 percent share.

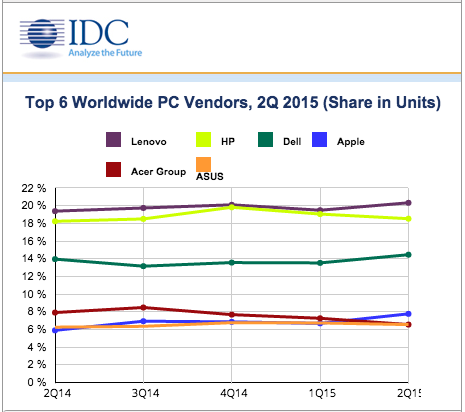

In global market metrics, IDC ranks Apple in fourth place with a 7.8 percent share of the overall PC systems pie, and outpacing Acer and Asus, although Gartner again says otherwise, ranking Apple behind both Acer and Asus, and in the 35.4 percent of the worldwide market designated “other.”

Manness says he believes there is good reason to think IDC is closer to the truth of the situation for several reasons which he reviews in his article., and observes that Mac sales languished in the two to three percent PC market range during the first years of the new century, but began to gradually pick up around 2004, which he attributes to the iPod “halo effect, entering a new phase in which sales grew more rapidly, particularly after the introduction of the iPhone in 2007.

Personally I think the switch from PowerPC to Intel processers had an even more profound effect on resurgent Mac system sales than did iPhone introduction in the mid-to-late years of the ’00s decade.

Manness notes a Mac sales growth lull in 2011/2012, but another breakout in 2014 with growth of over 14 percnt at a time when the overall PC market was shrinking, observing that Apple has gained PC market share in all but one of the last 37 quarters. He observes that while traditionally, Mac systems had been mostly purchased consumers and artists, with a trickle of enterprise sales, that dynamic has been changing lately driven by increased cognizance that there’s a computer that needs significantly less support than a Windows PC, and a burgeoning BYOD movement spearheaded by smartphones and more recently tablets and PCs, and with an ongoing halo effect from the popularity of iOS devices. He cites Statistics Brain data indicating that 75 percent of personal computers sold are to businesses these days, so expansion in that sector is necessary in order for Mac sales to continue growing.

Photo Courtesy Apple

In that context, Manness points to Apple’s MobileFirst partnership with IBM, which while nominally aimed at the mobile sector, also creates another nuance of the iOS device halo effect, with Mac benefiting under the radar, and he’s confident that IBM will be promoting Macs to some degree or other, perhaps even eventually moving to officially represent the Macintosh line. He also advises investors, who are the primary Seeking Alpha readership, to not dismiss the importance of the credibility that IBM gives to Macs in the enterprise, noting that few companies are regarded with such respect in major enterprise circles as IBM, and the impact of IBM sales personnel toting MacBooks will speak volumes to executives.

He also observes that while endemic prejudice against anything Apple in enterprise IT departments is still held by many, it’s eroding, with fewer IT folks dismissing the Mac as a “not a real computer,” disparaged as a “toy” by people “who did not really know what a general purpose computer is (from a technical definition, at least)”.

He also predicts that while Mac sales metrics should continue to rise, it is also expected that competitor numbers will surge even more with Microsoft’s imminent Windows 10 release,at least assuming that Windows 10 is greeted favorably, with no major problems. However he observes that with Microsoft’s new OS to be a free upgrade for current consumer users, PC buying pressure may be less than otherwise might be expected, and regardless, after a couple of quarters, MAnness forecasts a return to the trend of Apple growing faster than the overall PC market, and slowly, but inexorably, gaining market share.

For more arguments why, you can read the full report here:

http://bit.ly/1MmEBL6