Smartphones: It’s Apple and Samsung vs. The Rest

Apple boasts 76% brand retention and Samsung attracts 34% of all consumers switching device brands according to new data from Xerox subsidiary WDS undenfscoring that breaking the smartphone duopoly won’t be easy.

Despite ground-breaking features and super-slick marketing, other-brand smartphones launching at Mobile World Congress this week in barcelona, Spain, have a difficult task ahead if they have aspirations to break the Apple and Samsung duopoly. Analysis of brand retention across smartphone manufacturers by WDS shows that 76% of Apple customers replace their iPhone with another iPhone, and 34% of all consumers switching device brands choose Samsung.1

WDS, a specialist in customer care solutions for the mobile industry, conducted more than 3000 interviews with smartphone owners in three flagship smartphone markets; the U.S., UK and Australia. The data forms part of the company’s annual WDS Mobile Loyalty Audit, a global study of loyalty in the mobile industry.

Apple And Samsung Lead Brand Retention

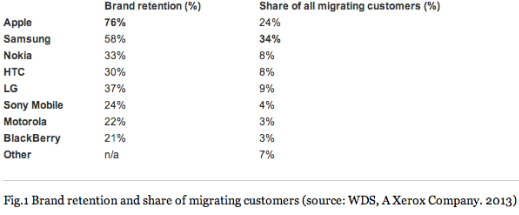

Brand retention (customers who replace their smartphone with another from the same manufacturer) is led by Apple and Samsung. WDS found that Apple retains 76% of its customers, followed by Samsung (58%). No other smartphone manufacturer managed to keep brand retention above 40%, (see Fig.1).

“For smartphone manufacturers, brand retention is one of the most important metrics to track. It’s a very solid indication of how successful their device upgrade cycles have been in retaining customers,” says Tim Deluca-Smith, vice president of Marketing at WDS in a release. “Both Apple and Samsung are doing very well in keeping customers excited and loyal to their product roadmaps.”

Fig.1 Brand retention and share of migrating customers (source: WDS, A Xerox Company. 2013)

Samsung: The Switcher’s Selection

While Apple leads in brand retention, Samsung is the top choice for consumers switching from other brands (share of migrating customers). In fact, a third (34%) of all switching customers moves to Samsung. Apple follows, attracting almost a quarter (24%) of all migrating customers. (See Fig.1).

.”

“This metric speaks a lot to the marketing might of Samsung. The company has been very successful in developing solid relationships with almost every mobile operator on the planet and then building devices to a variety of price-points. This exposes the Samsung portfolio to an enormous base of potential customers,” explains Mr. Deluca-Smith. “Combined with a strong brand retention rate, this positions Samsung well for 2014.”

The smartphone brand retention and migration data forms part of the WDS Mobile Loyalty Audit 2014. The full report is based on more than 4000 consumer interviews (conducted in January 2014) from the UK, U.S., South Africa and Australia.

”

Additional Data:

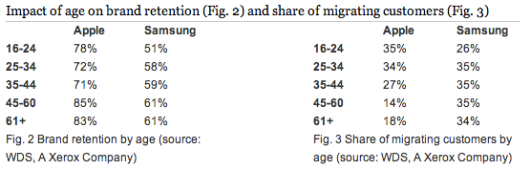

Impact Of Age On Brand Retention (Fig. 2) And Share Of Migrating Customers by

age(Fig. 3)

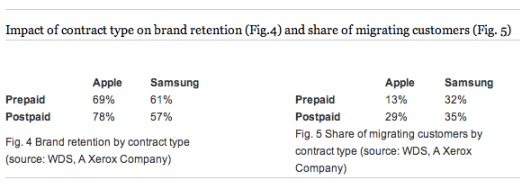

Impact of contract type on brand retention by contract type (Fig.4) and share of migrating customers by contract type (Fig. 5)

WDS, A Xerox Company, provides multi-channel knowledge management, care automation and analytics to help wireless brands deliver a more effective customer service experience and protect customer lifetime value.

For more information, visit: